We have great news. Here is our new weekly digest about the latest company news. See what has happened this week.

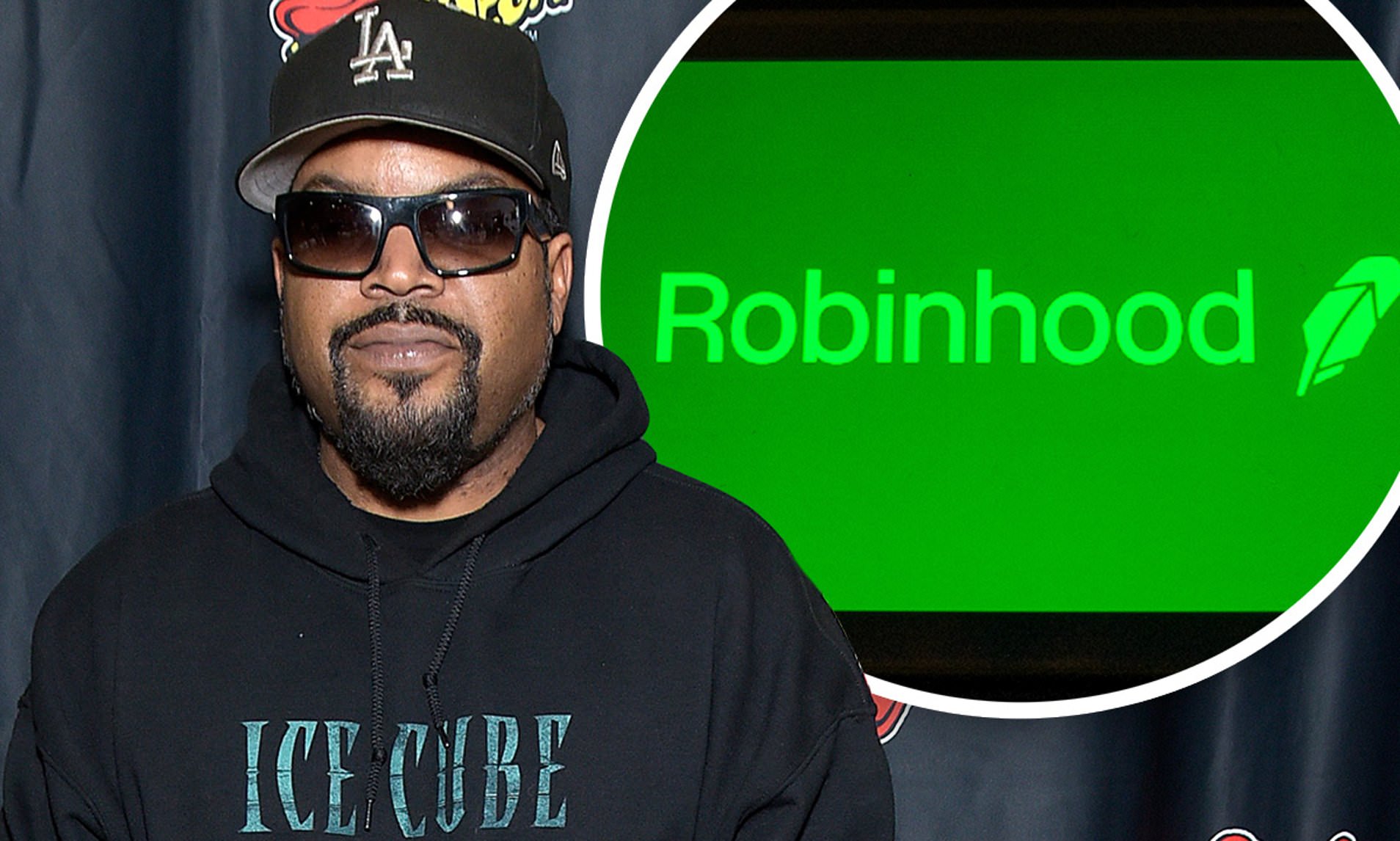

Ice Cube reopened claim against Robinhood

He did it as soon as the California Northern District Court said that Ice Cube has to admit his defeat or correct his claim in a lawsuit against the organization. Then he has applied a corrected complaint against the American online investing platform.

The application, sent to the court this month, accuses the organization of being a sharp and predatory firm that poses itself to be a firm that provides services and tools for its customers.

The claimant asserted that the organization terribly shows its confidence that it is free from the regulation that is followed by firms and citizens in the US.

Plus500 faced a 30% loss during Q2

One of the biggest Forex and CFDs companies, Plus500, published half-year trading results. Its information shows that the organization slumped down during the second quarter of this year both in income and the number of new consumers.

The organization mentioned that its positive factor during the first half of this year was witnessed by another very strong period of user acquisition, though, as noted in the report, that plunged in the second quarter.

Moreover, there was a continued high level of activity within the service driven by an active audience group which has soared over the last few years.

Swissquote expands the list of cryptocurrency offerings

The trading company, based in Switzerland, announced its expansion of the wide range of services connected with digital assets. It integrated Polkadot.

Polkadot is a next-generation blockchain protocol that provides various blockchains to unite and collaborate with each other within the provided ecosystem. This system was rolled out with the idea of making a better version of the internet, where control is provided to its users and not to giant companies. It was invented by Ethereum’s co-founder, Gavin Wood.

Polkadot is managed by Web3, a Swiss foundation that plans to build and develop top-notch technologies and apps for decentralised web software protocols.

XTB accomplished Dubai DIFC license conditions

Retail Forex and CFDs brokerage company that is based in Poland has published information. According to their info, the organization has completed all the necessary details set for it by the financial authorities of Dubai.

It is important to note that the company got preliminary approval by the end of the previous year. The organization noticed that it was its main goal to reach maximum international expansion, and operating within the United Arab Emirates was included in this plan.

The company added that it is now waiting for final verification by the financial regulator and its decision.

RoboMarkets lists more than thirty Brazilian stock CFDs in R Trader

European licensed Forex and CFDs brokerage firm has published information that it has integrated CFDs on Brazilian stocks to its R Trader terminal. The new trading tools implemented within the trading terminal are CFDs on stocks of the thirty most liquid organizations that are operating on Bovespa, the Sao Paulo Stock Exchange.

This list now includes such firms as Petrobras, Itau Unibanco, Banco Bradesco, AmBev, and Vale.

The brokerage company offers investment services and tools in many countries within the EU. It provides traders and investors with its own trading platforms.