Introduction

Trading financial assets such as futures, options, forex, and other derivative financial assets can be a lucrative income source for savvy investors. However, you don’t need extensive knowledge about the stock market to begin online trading, as there are various methods of generating income from trading securities.

If you’re looking to get started in futures trading, you can choose a wide range of trading platforms. Due to the overwhelming number of available options, it can be challenging to identify the platform that is best suited to your needs.

We have selected two of the leading securities trading platforms on the Internet, namely NinjaTrader and Thinkorswim. This article will delve into each platform’s unique features and provide a comparison to determine which is right for you.

If you’re an experienced online trader or just beginning to dip your toe into this complex and exciting world, read on!

What Is NinjaTrader?

NinjaTrader is a leading online derivatives trading platform. It allows users to exchange various financial instruments, such as forex, options, and futures.

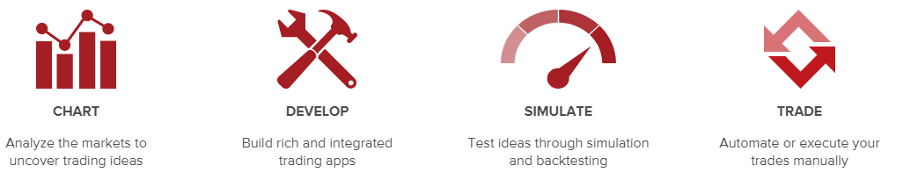

It has been providing its customers with high-quality trading software solutions since 2003. The advantages NinjaTrader offers its users are access to advanced analytical tools, which allows you to create charts and develop strategies to facilitate your trading activities.

Moreover, the platform offers its users the opportunity to participate in simulated trading to hone their skills.

The best part is that the service is free to use, with users only being charged for the premium features they opt to use. These features include Over Flow + and Trader +, both of which are ideal for advanced traders that require extensive financial analysis tools.

NinjaTrader has ensured that the platform is supported by numerous third-party developers that produce various apps and add-ons to improve the trading platform’s functionality.

What is Thinkorswim?

Thinkorswim is an online trading platform that deals with multiple financial assets. It is owned by TD Ameritrade, a leading broker in the financial services industry.

It specialises in futures and options trading and charges no commission fees on trades. This makes it an excellent starting place if you are looking to begin your day trading journey.

In addition to providing a comprehensive list of tradable securities, the platform is also an excellent resource hub for beginners looking to expand their knowledge base about various topics related to finance.

The platform is so detailed and comprehensive that it can be challenging for new traders to correctly navigate the website. The platform also requires users to utilise multiple trading platforms to fulfil their trading requirements.

For example, while thinkorswim’s tools are adequate for options trading, investors may be forced to turn elsewhere if they want to trade in equities and related instruments.

The order routing algorithm of TD Ameritrade attempts both price enhancement and speedy delivery of the customer’s whole order. The company’s price improvement figures reveal that, on average, most marketable equity orders receive a little more than 11 cents per share in price improvement. TD Ameritrade receives some reimbursement for order flow but states that its order execution engine does not assign priority. The firm does not report reimbursement for the flow of orders for the trade of options.

Clients can build and back-test a trading system and route their orders to some market center, but they cannot position automatic trades on the platform.

Is NinjaTrader Any Good?

The NinjaTrader platform offers tidy, completely customisable maps. It’s simple to adjust colours (for the backdrop, crosshairs, grid lines, text, etc.), fonts, and bar spacing/width, as well as the general style of your chart windows. You can conveniently attach technical metrics, techniques, and drawing methods that are all customisable in the table.

You can have access to a range of easy-to-use order entry interfaces, including Chart Trader, a terrific app that allows you to position and control orders directly from a chart. NinjaTrader was one of the first sites to provide this function.

The platform supports all standard order forms, including business, cap, stop business, and stop-limit orders, as well as specialised OCO (one cancels other) orders. If you are involved in automatic trading, NinjaTrader ‘s ATM Strategies can provide discretionary traders with semi-automated features to handle their positions. Alternatively, you can completely automate a technique using a point-and-click construction for non-programmers or using the NinjaTrader C # trading system.

NinjaTrader uses CQG Continuum as its primary data provider for live brokerage accounts, while Rithmic is also supported. Monthly data fees are expected for a full market depth option, or you can get top book data for reduced costs.

Data payments depend on the sharing of information. For context, the full market depth of CME data is $7 a month. If you need access to more resources, you should go for the CME package, which contains CME, CBOT, NYMEX, and COMEX for $21 per month.

Using the NinjaTrader Market Replay feature, a tool that helps with back-testing, business practice, and other business-related analysis, users can easily play, pause, and rewind historical price data.

With a financed account, the NinjaTrader platform is free to use for charting, market forecasting, and live trading. You don’t need a financed account to use the SIM trading platform. The installation process is quick, and you can open maps, configure colors, and add indicators and strategies as soon as you launch the platform.

The framework is versatile with many tools and services, and it takes some time to understand how to use all the functions. If you’re wondering how to use NinjaTrader, the company hosts free daily webinars to help you start. Topics include data connectivity, one-click order entry, workspace configuration, simple map formation, advanced settings, and plan automation.

A primary aspect of the platform worth noting is the opportunity to position virtual trades, complete with a fictional account and a profit/loss overview. Sim trading may benefit younger traders who have had no experience in trading — and grappling with unavoidable mistakes, such as expensive order entry errors, like pressing BUY instead of SELL.

Traders interested in real-time quotations and historical statistics must buy different data streams. Real-time quotes are given free of charge during the trial phase but must be charged if you search for real money purchases. A broker or NinjaTrader Brokerage achieves this.

The NinjaTrader software has a learning curve and takes a few weeks to get comfortable with it, particularly for newer traders. The business provides a robust and well-organised online reference library and a website for traders to explore problems and ideas with each other. The organisation also offers daily webinars, explaining the main aspects of the software, using them, and training sessions conducted by industry experts.

Is Thinkorswim Any Good?

TD Ameritrade has built a user-friendly website that is seeking to soften customers of all shapes and sizes. From account registration to commercial execution, the process is seamless and painless. New accounts can be opened in minutes, and a range of options are available, including investment vehicles such as Roth IRAs and custodial accounts such as UTMA / UGMA and 529 plans.

If you’re new to TD Ameritrade, they’ll get you up and running in a matter of minutes. You will fill out your application online. Generic investment accounts can be opened, financed electronically, and ready for trading on the same day. Non-margin accounts do not have a minimum deposit to open, and equity transfers are duty-free. If you’re not a computer-savvy or want a helping hand, you should reach out to new customer account specialists 24/7.

TD Ameritrade has an abundance of content to show people how to use different platforms. Thinkorswim, for example, is an intricate trading platform that comes with a little learning curve, particularly for new users. But TD provides a full Thinkorswim Learning Center with articles and videos covering all the app’s excellent functionality. In the Getting Started segment, you can get instructions about using keyboard shortcuts, configure the app, and use interactive features like Active Trader. There is a how-to article available on Thinkorswim for any single tradable defense. And even though you’re stumping the FAQ section, the customer service agents are standing by 24/7.

Bringing new buyers up to speed and ready to trade is a vital part of TD’s goal, but it also appeals to traders’ skilled population. And with these traders in mind, there has been some significant growth of the platform. Experienced traders can get Level II quotes, direct market entry, and various order forms for quick and reliable trading. Over three hundred different charting instruments can be incorporated into the analysis, plus risks and risk analysers make it easy to model trades with predicted outcomes. Usability is a two-way street — investors require resources that complement their experience level—working your way from a concept to trade means using well-organised two-level menus on the website.

There is a ticket available at the bottom of any screen that you can remove and float in a separate window for more comfortable entry. Charts may also be detached and floated to build up a trading environment, but this is a more complicated method relative to what is possible with thinkerswim. There are fast buy and sale buttons that pop up as you float over a ticker and press them to load simple information into your ticket. If you want to submit a conditional request, you’ll need to go to an extended trading ticket that can be reached by clicking on it. On Thinkorswim, you can set up your screens with your favourite tools and access to the exchange. Default formats are often easy to use, and most traders would be familiar with drawing methods, technical metrics, and data visualisation tools. Thinkorswim helps traders to develop their analytical software and to use an integrated programming language called thinkScript.

On the web, you can customise the order type (market, limit, etc.), order quantity, order side (buy or sell), and tax-lot methodology. In thinkorswim, you can also customise order templates for each asset class to access multi-order strategies with a single click. You can stage orders for later entry on all platforms.

Conclusion

While both trading platforms have their merits, NinjaTrader provides a better overall package, as it has a host of desirable features for new and experienced traders.

These include advanced charting, market analysis, simulated trading, and other features. The wide range of options is also a plus point, as it contains the possibility to trade a variety of order types.

If you’re looking to get started in futures or options trading, NinjaTrader is the perfect starting point. Good luck!

https://www.trustpilot.com/review/ninjatrader.com