Overview

Today the diversity of companies providing services on the global financial markets is so wide that it might be difficult for beginning traders to make the right decision. There are a lot of aspects to consider, including safety, trading conditions, trading costs, fee structure, and many others.

If you just started trading and it seems difficult for you to analyze all these aspects on your own, here is our CMC markets review. Our experts examined the CMC Markets UK Plc company to find out whether it offers profitable conditions and a high level of security to retail investor accounts. Keep reading this CMC Markets review to find this out.

CMC Markets is a UK-based organization. It proposes a lot of brokerage services through its trading platforms available in an online mode. It is a general business that is catalogued on LSE.

CMC Markets proposes first-class services for all categories of participants, with a large list of suggestions and a usable and extremely advanced terminal — Next Generation.

CMC Markets is authorized by FCA, which lends trust, as does the extent to which CMC Markets emphasizes account safekeeping. Negative balance security presents customers with peacefulness of mind, and the premium for stop-loss execution is rational, given the account-saving risk management it supplies in changeableness market conditions. There are no huge costs, and complimentary withdrawal through wire transference is a great feature.

Key Services

Review

CMC Markets is a reputable business with a long history dating back to 1989. It is one of the most reputable brokerage services based in the UK. Over the years of participation in the industry, the provider has managed to adapt its services to the ongoing technological development tendencies. CMC Markets shares are publicly traded on the London Stock Exchange.

CMC Markets is famous for the development of the original terminal, known to users under the name “Next Generation”. This digital product is a web terminal that is famous for an impressive number of top-notch solutions. Alongside this original development, users are free to download one of the most widely used downloadable terminals, MetaTrader 4.

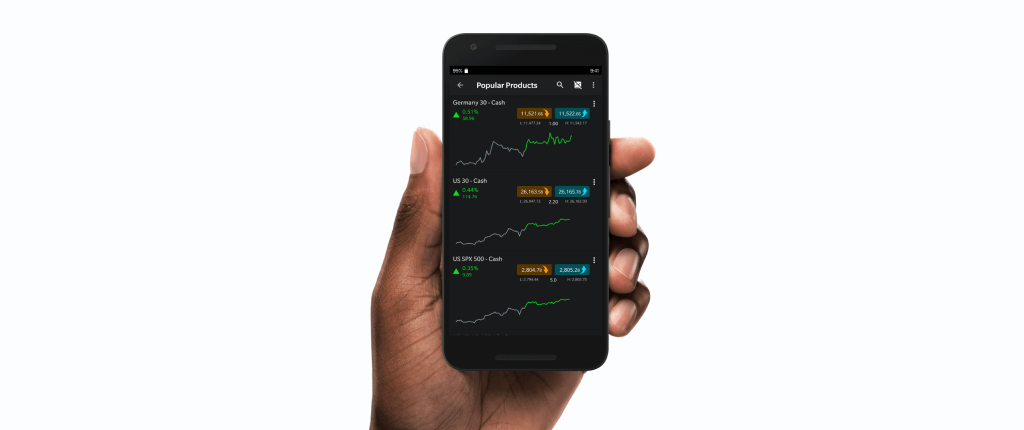

There is also a mobile-based application for those who want to have the possibility to place orders and close deals right on the go. The CMC Markets application for smartphones will allow doing this quickly and conveniently. With this, you can access the entire list of suggestions, including CFDs and spread betting available for a few categories of assets.

CMS Markets is often thought to be devoted rather to experienced and institutional participants. However, this operator doesn’t provide some features that are most common for operators with professionals. For instance, CMC Markets doesn’t display a free API to traders.

One of the advantages of CMS Markets is the set of stop-loss orders and free outgoing transactions via bank wire transfers.

CMC Markets is an international company with multiple rewards that poove its commitment to growth and development. In 2022, ForexBrokers.com declared CMS Markets as the No.1 Platform Technology for the second time in a row. A year prior, CMC Markets was nominated multiple times during different events. The City of London Wealth Management Awards 2021, for instance, acknowledged the company as the Best Spread Betting Provider.

Who Will Benefit from CMC Markets

CMC Markets is one of few brokers that might be considered for both complete newbies, who are just learning to trade CFDs, and forex and are studying how spread betting works, and for investors with many years of experience and long lists of successful cases, who need to gain the possibility to speculate many tradable securities.

Pros & Cons of CMC Markets

Pros:

Extensive range of assets

Regulated by FCA

Emphasis on the instant client support

Emphasis on a brand-new and positive customer experience

Research tools correspond to the highest industry standards

Offers protection for client accounts

Cons:

Does not accept US clients

High CFD spreads for a number of indices

Costs

You should be aware of the costs offered by CMC Markets UK Plc company in order to be able to calculate all your further expenditures. Shaping a budget correctly is one of the most basic components of profitable trading strategies. You won’t be able to do this properly without knowing what additional payments you are required to pay when forex trading.

Trading costs

These extra payments are common for the majority of modern forex brokers. Some provide fixed commissions, but the majority of providers, including CMC Markets, charge CFD trading or forex trading fees through spreads.

We suggest that the spread of CMC Markets is competitive if we take into our consideration the market peculiarities of the modern period. The vast majority of trading fees are included in these spreads. Actually, this is how international brokers, and CMC Markets, in particular, generate profits.

The stop losses features might be used only by users who trade via the original priority platform on a premium plan, which is charged by CMC Markets additionally.

CMC Markets doesn’t impose additional commission upon participants who make money on trading stocks and ETF products. The process of charging depends on the types of accounts.

It is said that larger positions come with a wider selection of spreads. However, this is not the same for the represented trading platforms. Details might be examined only on a specific terminal.

CMS Markets reports that the minimum spread for currency pairs varies between 0.7 and 1.0 pips. These are data for majors, including EUR/USD, USD/JPY, AUD/USD, GBP/USD, and USD/CHF. If you are going to switch from one trading platform to another, you should be ready to meet different spreads, even if you are going to trade the same products.

Talking about CFD/spread betting, it’s necessary to note that the S&P 500 spread amounts to 5.00 pips, which is much higher than average conditions across the industry. Because of this and also due to the fact that there are no hours during the day when it’s not charged, the instrument cannot be considered appealing to traders. Nasdaq and DJIA offer much more attractive conditions on the same product than CMC Markets – 1.0 and 1.6 pips, respectively.

Non-trading Fees

Non-trading fees are extra amounts that don’t relate to trading activity directly. But they do relate to basic options, without which a trader won’t be able to start trading. Here are the non-trading commissions that must be paid by CMC Markets customers.

Account Minimums

CMC Markets doesn’t impose a requirement of a minimum account investment for users who want to start trading through a real account. Nevertheless, if you want to be provided with additional perks and features that might boost your profits, you need to upgrade your plan. This is especially relevant for clients who can afford to operate high capital. It’s more reasonable for them to pay for premium stuff such as a personal account manager, for example. Depending on the account minimum, you might also claim priority access to new assets listed and other benefits offered by CMC Markets.

Inactivity fee

An inactivity fee is a type of extra payment charged for individuals being inactive. If you aren’t active on your personal trading account on CMC Markets for a year, you will be charged a £10 fee every following month.

An inactivity fee is the only non-trading commission charged by CMC Markets.

CMC Markets Review: Online Applications

CMC Markets offers MetaTrader 4, which is believed to be one of the most frequently used trading terminals ever available. In spite of this fact, some modern advanced traders consider it a bit outdated. The ones who are looking for a more modern and customer-oriented trading platform may prefer Next Generation.

Next Generation trading platform

The Next Generation platform might be used by clients of CMC Markets in web, mobile and tablet versions. Despite its extensive functionality, it’s often criticized for being difficult to navigate. It offers an extensive number of digital solutions that boost the productivity of technical trading. It also doesn’t have additional requirements or exchange integrations to provide cryptocurrency CFD trading and spread betting. Nonetheless, users report that they are discouraged from using this platform because of the high average trading fees.

With Next Generation, customers can use such trading tools as:

- impressive charting features;

- 115 indicators;

- 10+ types of charts;

- 30+ drawing tools;

- watchlist;

- Reuters news feed.

Next Generation has three basic order types with the option of attaching “take profit” and/or “stop-loss” orders to them. In addition to this, there is an option of setting a starting stop-loss feature during the market orders execution and then altering it to a guaranteed stop-loss feature after the order is executed.

The displayed orders types are the following:

- Market

- Limit

- Stop

The Next Generation Mobile Platform

The Next Generation mobile application is supported by both iOS and Android. We consider it much better than MT4 mobile in terms of usability and efficiency, although it introduces fewer solutions than the browser-based terminal.

The Next Generation mobile app is often praised for emphasizing advanced chart optimization. It also provides users with the possibility to get quickly notified about essential updates via the features of push notifications or alerts sent to one’s email. Although the app doesn’t have two-step verification, it provides the ID entry feature, which disables somebody else from accessing your account. The next Generation mobile app also offers more CFD options and has better share capacity than MT4.

Traded Product Range

CMC Markets offers customers a very wide range of financial assets. From this perspective, CMS Markets is one of the most competitive providers in the industry. CMS Markets website says that the provider offers around 10,000 tradable products from different financial markets:

- over 300 currency pairs

- over 90 Indices

- 14 Crypto products

- 0ver 9000 Shares and ETFs

- over 100 Commodities

- over 50 precious metals

Spreads of CMC Markets are reported to be not very high in comparison with competitors if we take a look at all the assets. However, when it comes to individual stock securities, we might notice specific margin percentages. To be more specific, here, these percentages might be not lower than 20% on the shares of the UK- and US-based companies. The level under which the position size falls impacts the margin rate applied for large position sizes on stock securities.

CFD trading

CMC Markets also enables CFD trading. However, you shouldn’t try it without any experience or background knowledge. Before entering this venue, make sure you understand how CFD trading works. The thing is that CFDs are complex instruments. When working with CFDs without any experience, you run the risk of losing your cash. 80% of retail investor accounts lose money when spread betting and/or trading CFDs with CMC Markets.

Customer Support

Today, modern forex brokers realize how important it might be to be able to quickly respond to clients’ urgent requests in order to satisfy their needs. If this vital aspect is neglected, the broker will be criticized not only by beginners but by professionals as well. CMC Markets managers understand the importance of Customer support services.

To receive support from the CMC Markets broker, the clients should contact it via a convenient means of communication. This range includes all the possible methods you can think of, such as phone calls, email messages, and FAQs libraries. You can call the local branches of the CMC Markets if there are any in your country. Phone support works 24/5.

The company has 13 branch offices licensed by regulatory agencies. You may find them on social media as well. The company has Twitter and Facebook accounts.

Research Tools

CMC Markets is a very good option to choose for those who are looking for brokers with an extensive range of research tools. It provides updated information both via its in-house channels and via third parties. Holders of live accounts, for instance, may access Morningstar quantitative equity research reports, which is a huge benefit in terms of technical analysis of CMC Markets.

Many helpful sources of information are available on the CMC Markets website. Clients can adjust search function setting and filter news by region and classes of assets to which the news are related. The CMC Markets website also enables using of a standard economic calendar. The only significant disadvantage we’ve noticed is the lack of well-optimized search functions that would allow fast searching in the archive of the materials.

Security

Financial Conduct Authority FCA

CMC Markets’ financial activities are supervised by a leading investment regulatory institution – the Financial Conduct Authority (FCA). Authorization by such a respectable and well-established regulatory body highlights the fact that the CMC Markets broker wants to ensure the undisputable safety of funds of customers.

Clients’ assets are protected because CMC Markets has to hold all assets in segregated accounts at trusted international banks that cannot be accessed if clients themselves aren’t aware of this.

FSCS

CMC Markets is also a member of the Financial Services Compensation Scheme (FSCS). This makes the broker provide additional asset protection of up to £85,000. Despite that, it’s important to draw your attention to the fact that there are no layers of private insurance.

Negative Balance Protection

CMC Markets also enables the feature of negative balance protection. According to the rules of this program, clients, who deposit money on live accounts operated by CMC Markets, won’t lose more funds than their total deposits.

Data Protection

CMC Markets is always struggling to improve its digital-based services. This is obvious when taking a look at the technologies implemented to provide software security. CMC Markets enables a two-step verification process and also a special solution that logs out inactive users.

Advantages

Negative balance protection, discounts on maintenance for qualified traders, free API, web and mobile trading available, advanced charting package, trading strategies videos, Next Generation trading platform

Clients: Institutional and retail clients

Support: 24/7

Team