In short, “laundering money” is a fraudulent activity to make illegally obtained money look legitimate. Fraudsters create the appearance of official income with the help of documentation, other organizations, and banks. But other ways that should be considered.

Unlike cashing out, “laundering” is associated with illegal income-generating activities. In this case, we are usually talking about large sums that are difficult to withdraw legally without a plausible explanation to the regulatory authorities. In addition, cashing is the process of turning digital assets into cash, and laundering often implies the opposite: cash is credited to bank accounts to substantiate their legitimate sources, after which it can be legally cashed out.

Laundering money is the concealment of the actual source of earnings. Tax evasion or cashing out can already serve as secondary or auxiliary factors. The “laundered” funds are utilized for financing the company, terrorist financing, and personal needs.

3 stages that we need to know

The money laundering process can be carried out in three stages, and among them, we can highlight:

- Detachment. Initially, the dirty money was received illegally. Funds are withdrawn abroad (to a foreign bank), transferred to the accounts of individuals or legal entities.

- Placement stage. In the laundering placement, dirty money is added into the legal cash flow. As a rule, the attacker already has a fictitious confirmation of the legitimate sources of their earnings.

- Integration stage. This is the final integration step when the appearance of legitimate possession of wealth is created. In the integration stage, the owner of funds can freely withdraw them, transfer them to any accounts, purchase various items and real estate.

Sometimes some stages of money laundering are skipped. For example, if the dirty money is immediately credited to a bank account, its implementation is no longer required. But this is a risky step since the bank (foreign bank) will ask about the origin of the income, and the profile may be frozen without any warning. Integration is also not always carried out. That is, the “laundered” money remains in different accounts and is used as needed. In some cases, the situation requires waiting for a certain period to proceed to the third stage, but still hiding the source of funds is the key goal for fraudsters.

After passing through the laundering process, the money is reinvested in illegal spheres. It can be repeated an unlimited number of times or carried out once to legalize a large sum.

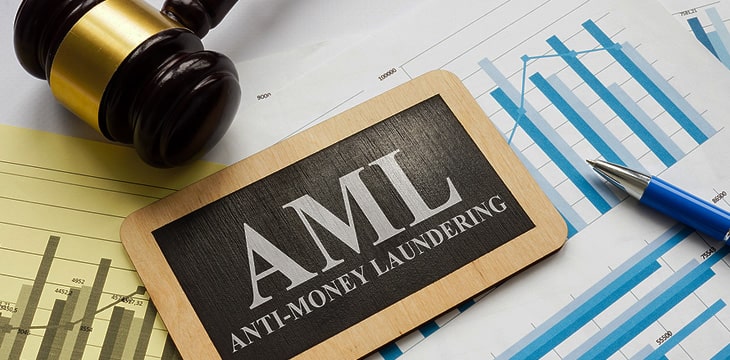

It is worth noting that money laundering is an illegal operation and is punishable by law enforcement. Thus, money laundering can lead to criminal liability, both for fraudsters and for a part of the financial system that participated in these illegal activities: bank or financial firm. A large fine or a set of restrictions may be issued to the bank. Such cases also spoil the reputation of the organization, and customers lose confidence in it. In order to avoid such cases, two methods have been developed to combat this: KYC, AML.

What are KYC and AML?

KYC — Know Your Customer или Know Your Client. This is the principle of activity of financial companies (financial system: banks, exchanges, bookmakers, investment, and mutual funds), obliging them to recognize the counterparty’s identity before conducting a financial transaction. The goal of such a policy is to learn more about their customers, monitor financial transactions, reduce customer risks, and prevent illegal activities like terrorist financing, bribery and corruption.

AML — Anti-Money Laundering. It is important to note that the abbreviation should have been longer, AML CFT CWMDF — anti-money laundering and counter-terrorist financing and counter-weapons of mass destruction financing. Parts of this long abbreviation can be found in many legitimate system documents and company security policies.

A list of some business features that can trigger an AML check:

- conducting business based on cash settlements (or a significant amount of the company’s funds in cash);

- keeping the large sums in various profiles , including banks;

- transfer funds (assets) abroad into the foreign bank;

- buy cash settlement instruments (for example, futures, options, and currency derivatives, assets);

- investing in securities through brokers or firms.

Customer identification (KYC) is a segment of anti-money laundering (AML). KYC can be called a set of procedures and tools, a principle within the framework of the general AML policy. Thus, both of these strategies should be used together to fully protect your business.

KYC and AML for the cryptocurrency segment

The emergence of cryptocurrencies has expanded the market of financial system (legitimate financial system) tools and raised regulation issues. At the beginning of the crypto boom, privacy policy became the main issue, but the need to ensure the security of transfers led to stricter requirements for user personalization.

KYC and AML requirements are met when obtaining a license to register a currency.

Compliance with the KYC and AML policies show that the service is trustworthy and it is working in accordance with the current regulatory framework. To the detriment of anonymity, cryptocurrency users receive the security of their funds.

KYC and AML solutions on Finarm

It is important to note that Finarm has a solution for financial companies. So they can operate according to the principles of KYC and AML. Our experts will find you the most suitable KYC and AML services that will meet your needs and goals.

At the moment, it is very important to take care of your security, especially in the field of crypto. If you want to protect yourself or your company, calmly dispose of your funds and not arouse suspicion from law enforcement. It’s easier to start following the principles of KYC and AML right now. In turn, FINARM will help you find a provider and start operating legally, according to KYC and AML requirements.