MetaTrader trading platforms are very popular and are considered one of the best programs on the market. They provide traders with access to a wide range of financial instruments both in the Forex and stock markets, offer a large number of indicators, order types, time frames and allow users to create and test strategies using easy to learn programming languages: MQL4 and MQL5. The MetaTrader programs are specifically designed to make instruments such as futures and CFDs available and easy to use, even for beginners.

MT4 and MT5 have similar features, but support different types of financial instruments for exchange and investment. In this article, we compare and explain the differences between the MT4 and MT5 platforms, as well as what platform to choose for trading and investing.

What is the deal with MetaTrader 4 vs MetaTrader 5?

MetaTrader is a well-known platform created by MetaQuotes in 2000 for chart analysis and Forex trading. The company has released 5 versions of the software, but now only the MT4 and MT5 platforms are used. In 2021, after more than 20 years, the platforms are still among the most popular and are being updated to this day. The company plans to release updates for these products in the future, as users are interested in them. But arguments about MetaTrader 4 vs MetaTrader 5 advantages do not stop.

The programs have many add-ons that can be created and shared by traders themselves. Any user can easily find, install, configure and use them in the asset trading application. The programs are available for free: you can download them from the official website and start using them. To do this, the user needs to connect a trading account previously registered with the broker.

What is the MT4 platform?

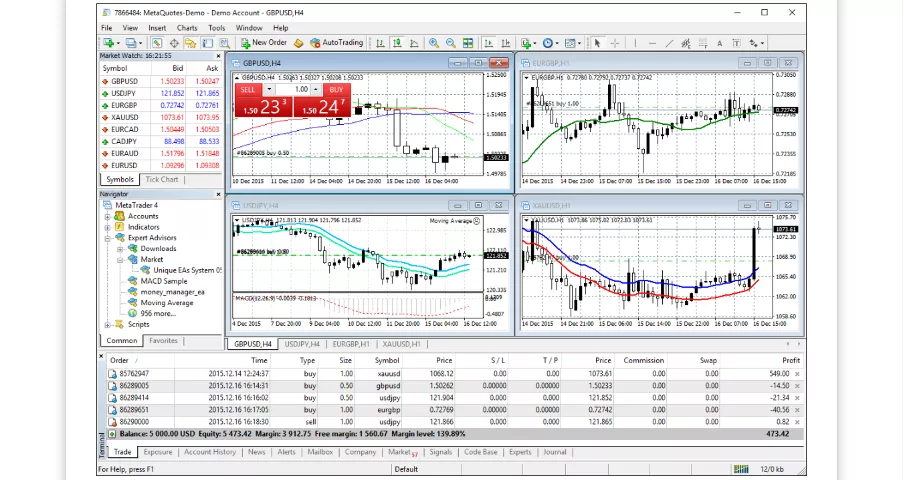

In 2005, MetaQuotes first released the MetaTrader 4 (MT4) platform, which specialized in Forex trading. The interface is designed to make trading easier, but at the same time provides various tools for professional traders: flexible orders, various chart and timeframe settings, analytical tools and news to track dynamics, position management, development of automated trading systems, and many other important options, that make forex trading a lot easier.

What is MetaTrader 4 used for?

MT4 contains both basic and advanced tools for trading currencies such as USD, EUR, GBP, CAD and others. This is the first program released by the company, which has gained global popularity. The platform is available on mobile and desktop devices, as well as in the web version. The phone app allows you to trade anywhere and anytime, while away from home or on the road.

To start using MT4, you must first register an account with a brokerage company, deposit money into the account and connect it on the platform. The process is quite simple and usually takes no more than a minute: the user specifies the email address, phone number, and personal data. Some brokers require you to identify your account in order to access trading – this is a standard procedure performed in accordance with the rules of regulators.

The platform is suitable for both beginners and high-level traders. Beginners can expand their trading experience and get acquainted with various financial instruments by exchanging assets on a demo account, while eliminating the risks of losing real money. You can place an order and change the conditions at any time in one click. Forex traders can create their own strategy using the MQL4 language and add additional indicators or Expert Advisors created by other experts.

Is MetaTrader 4 good?

Traders’ opinions differ. Some analysts criticize the platform for providing brokers with the technical ability to execute orders under unfavorable conditions for clients. In addition, it does not have a built-in economic calendar and does not show

depth of market. However, most users consider MetaTrader 4 to be one of the best programs for Forex traders. The platform is supported by almost all major brokers.

What is MetaTrader 5?

MetaTrader 5 looks almost the same as MT4, has very similar functionality and is no less easy to use, but is designed for trading on the stock market and has some advanced options. The first release of Metatrader5 (MT5) took place in 2010. In addition to currencies, the new platform allows users to trade any other asset: stocks, bonds, oil, gold, etc. MetaTrader 5 supports CFDs, futures and options.

This is a slightly improved platform – MT5 offers the community of traders advanced options for executing orders and a lot of order types, such as Limit and Sell Stop, depth of market display, backtesting automated trading algorithms, an economic calendar for market analysis, and more trading indicators built directly into the platform interface.

How to work with MetaTrader 5

MT5 works just as MT4, but with a few minor differences that we’ll cover further down the line. The process of creating an account, trading, switching time frames and setting up charts is almost identical. If you have already worked with MetaTrader 4, the interface will be familiar to you.

MetaTrader 5: how to use it

It is easy even for a beginner to learn the MetaTrader 5 interface. As in MT4, you will first need to create an account with a broker, and then connect it to the terminal, after that you can immediately start trading. Real and demo accounts, where you can train without risks, are available. MT5 offers multiple types of pending orders: Stop Buy, Limit Sell, Limit Buy and Stop Sell. Detailed guides on using MetaTrader can be found on the official website of the product.

Advantages of MT4 and MT5

Both MetaTrader 4 and MetaTrader 5 provide flexible settings and high order processing speed. MetaTrader uses its own high-performance servers, so orders are executed well, with minimal slippage and delays.

The basic built-in functions provide the trader with everything necessary for exchange trading. Both products have tools for testing a trading system created by a trader or downloaded from the MQL5 Community website, using historical data without risk to capital. This is an undeniable advantage, especially for beginners who may lose their investment without having any experience in trading.

Users can configure different timeframes: seconds, minutes, hours, daily, weekly, and even monthly. However, the number and variety of timeframes differ when comparing MT4 and MT5, which will be discussed in the next section.

MT4 vs MT5: What are the differences between them?

If you are not sure, what to choose – MT4 or MT5, consider first your preferred trading instruments and markets. Before choosing a platform, you need to analyze and compare them to determine which one is more suitable for you to trade. First of all, if you prefer investing in securities and other exchange-traded assets, and want to use additional tools, MetaTrader 4 does not suit you, since it is designed only for trading on Forex. However, MetaTrader 5 would be perfect for you. And vice versa, if you want to specialize in Forex – use MT4.

This is the main difference between the two platforms. When comparing, consider not only the set of financial instruments but also other parameters that are suitable for you. For example, MT5 contains an economic calendar that allows you to track financial events, and supports pending orders, including Limit and Sell Stop, Buy Limit, and Stop Limit, Buy Stop and Sell Stop Limit.

Netting. MT5 supports an account system that allows you to have only one open position at a time for one financial instrument, while there are no such restrictions for the second platform. In other words, new open orders for one financial instrument are combined into one position and averaged.

The number of financial instruments. In MetaTrader 5, there is not only wider selection of financial instruments, but also more trading indicators, scripts and expert advisors. The number of timeframes is also higher: 21 versus 9 for MT4.

The number of time frames. Expanded selection of time frames allows traders and investors to track market dynamics more precisely.

Depth of market. MT5, unlike MT4, reflects the depth of market and expands the opportunities for hedging assets.

Economic calendar. In MetaTrader 5, comprehensive information on the stock market is published, including quote prices, events, company data, and much more. For example, international reports on various indices and other events on the economic calendar are published every day.

Programming languages. Metatrader 4 uses MQL4 and Metatrader 5 uses MQL5. Scripts and indicators written in MQL4 will be incompatible with MT5, and vice versa.

Email. Both versions of the program have a chat for traders and a mail service, but MT5 has the ability to attach files when sending emails.

MT5 also has an option to partially fill an order when a trade is executed with the maximum lot volume currently available for trading on the market, and you can also set additional execution conditions for the order. The MT4 platform only supports Fill or Kill orders. This means that the order can be only canceled or fully executed.

FAQ

What is the MT4 trading platform for?

Metatrader 4 is one of the most popular trading platforms in 2021 among Forex traders for the exchange of currency, oil and precious metals such as gold or silver. The program has achieved such popularity due to the fact that its interface is easy to use, but offers a wide variety of tools: indicators, Expert Advisors and scripts.

Is MetaTrader 4 still available?

Yes, it is. MT5 is not just a major update to the platform, despite the fact that the name seems to be a continuation of the previous version. It is designed specifically for trading on the stock market, while MT4 is tailored towards forex traders. This is the main difference in the software. MT4 and MT5 are two different solutions with different sets of trading instruments.

Can I use Metatrader for stock trading?

Specifically for trading stock market assets such as stocks or bonds, Metaquotes has created MT5. The platform supports an unlimited number of financial instruments that can be added in the quotes window and a wide variety of time frames..

Can I use my MT4 account in MT5?

No, you can not. You can switch between Forex and securities trading accounts, but you can’t use the same account for both Metatrader 4 and Metatrader 5. The type of accounts supported will vary, but a sufficient number of brokers provide trading accounts for either product. Thus, you can trade on both trading platforms simultaneously, but you have to use different accounts.

Is MetaTrader 5 a safe trading platform?

Yes, especially when it comes to mobile and desktop platforms. The web version can be hacked using phishing, but this method of hacking is not available for other clients. Brokers do not control MetaTrader and cannot access it. It is an independent platform.

Key risks are associated only with the use of instruments that MT5 offers, especially those that include leverage: futures or CFDs. If you follow the rules of safe trading and do not use high leverage, the risks will be less high.

How to switch from MT5 to MT4?

MT4 and MT5 trading platforms are different programs, so you can install and use both versions on the same device using different accounts. You need to download MT4 separately, register a trading account and connect it to the program.

What time does MT5 use?

By default, MT5 uses GMT + 2 hours, which is the same as the closing time of the New York Stock Exchange (NYSE). This is the server time displayed on all clients, and it cannot be changed within the program itself. But you can use Expert Advisors that will change the displayed time.

Summary

Users may have the erroneous opinion that the MetaTrader 5 is an improved version of MT4. However, this is not quite true. The platforms are designed for different tasks, so they differ in functionality. This is the main criteria to choose: MT4 or MT5. Use MT4 if you want to trade only on the Forex market. But if you are interested in investing in securities and trading instruments with leverage, then MT5 would be better, as it uses tools suited to the stock market, an expanded set of strategies and order types, supporting partial filling instead of Fill or Kill.